california mileage tax rate

The money so collected is used for the repair and maintenance of roads and highways in the state. Find Your Tax Rate.

Irs Raises Standard Mileage Rate For 2022

The rates for deductible medical travel and moving expenses.

. And 14 cents per mile driven in service of charitable organizations 2. 15 rows Standard Mileage Rates The following table summarizes the optional standard mileage rates for employees self-employed individuals or other taxpayers to use in computing the deductible costs of operating an automobile for business charitable medical or moving expense purposes. Related HR Manual Policy.

I have been resisting against all common sense leaving California completely. Between 1993 and 2020 average fuel efficiency improved by approximately 26 according to a 2020 report by the Institute on Taxation and Economic Policy a liberal think tank meaning drivers on average can go an extra 75 miles between fill-ups. The 43 cent per-mile tax along with a two new half-cent regional sales taxes are intended to help fund SANDAGs 160 billion long-term regional plan.

Californias Proposed Mileage Tax. Tax Professionals Topics Serve Your Clients. Identify a Letter or Notice.

The relocationmoving mileage reimbursement rate for all current state employees and new-hires to state service is 16 cents per mile. However if your employer pays more per mile you may face some taxation on your mileage reimbursements. And the California Labor Commissioner has taken the position that if the employer reimburses at the IRS rate it has satisfied its obligation.

2022 Personal Vehicle Mileage Reimbursement Rates Unless otherwise stated in the applicable MOU the personal aircraft mileage reimbursement rate is 1515 per statute mile. For the second half of 2022 the standard mileage rate for business use of an automobile will increase from 585 to 625 per mile. California has announced its intention to overhaul its gas tax system.

Proponents argue that the state gasoline tax of 529 cents per gallon could be replaced with a miles driven fee of 005 cents or so per mile driven under proposed state legislation. 2021 Personal Vehicle Mileage Reimbursement Rates Unless otherwise stated in the applicable MOU the personal aircraft mileage reimbursement rate is 126 per statute mile. 10 They both increased the reimbursement rate 25 cents from 2021.

Today this mileage tax. Most employers reimburse mileage at the IRSs mileage reimbursement rate. 2 days agoThe new rate for deductible medical or moving expenses available for active-duty members of the military will be 22 cents for the remainder of 2022 up 4 cents from the rate effective at the start of 2022.

California mileage reimbursement law aligns with this rule so as long as your employer pays the standard 56 cents per mile your mileage reimbursement is not taxable. Have found Florida to be much. The mileage deduction rate for 2020 went into effect on Jan.

However an elimination of the gas tax in exchange for the VMT isnt guaranteed. You can deduct your mileage at the standard rate of 18 cents per mile for 2022 and 16 cents per mile for 2021 or you can deduct your actual costs of gas and oil. These new rates become effective July 1 2022.

18 cents per mile driven for medical or moving purposes for qualified active-duty members of the Armed Forces up 2 cents from the rate for 2021 and 14 cents per mile driven in service of charitable organizations. Register for a Permit License or Account. The rate is unchanged from 2021.

Can I Sue My Employer for Unpaid Mileage. Beginning on January 1 2022 the standard mileage rates for the use of a car also vans pickups or panel trucks will be. The motor vehicle fuel tax is imposed upon each gallon of fuel entered or removed from a refinery or terminal rack in this state.

This means that they levy a tax on every gallon of fuel sold. Traditionally states have been levying a gas tax. For 2022 both the IRS and the California Department of Human Resources suggest mileage reimbursement rates of 0585 per mile.

585 cents per mile driven for business use up 25 cents from 2021 rates 18 cents per mile driven for medical or moving purposes for qualified active-duty members of the Armed Forces up 2 cents from 2021 rates and 14 cents per mile driven in service of charitable organizations. Drivers increasingly are turning to more hybrid electric and fuel-efficient cars. CA and New York allow exclusion from income for qualified moving expense reimbursements.

California will be losing another tax payer between all taxes to the statecounty I pay about 12kyear. The state says it needs more money for road. But employers do not have to use the IRS rate.

December 11 2017 633 PM CBS San Francisco. The IRS provided legal guidance on the new rates in Announcement 2022-13 PDF issued today. Beginning on January 1 2022 the standard mileage rates for the use of a car van pickup or panel truck will be.

California Department of Tax and Fee Administration Cities Counties and Tax Rates. The most common travel expense is mileage. 18 cents per mile driven for medical or moving purposes for qualified active-duty members of the Armed Forces up from 16 cents for 2021.

The rate is set by statute and remains unchanged from 2021. 2021 the internet website of the California Department of Tax and Fee Administration is designed developed and maintained to be in compliance with California Government Code Sections 7405 and 11135 and the Web Content Accessibility Guidelines 21 Level. As of June 18 2021 the internet website of the California Department of Tax and Fee.

Californias Proposed Mileage Tax. I dont want to sell my home but it is time. Mileage reimbursement rates do not necessarily have to be set at the IRS rate but use caution.

Workers who use their personal vehicles for business purposes will have to track their mileage. Mileage reimbursement based on IRS mileage rate is presumed to reimburse employee for all actual expenses. Effective January 1 2021 the personal vehicle mileage reimbursement rate for all state employees is 56 cents per mile.

58 cents per mile for business miles driven up 35 cents from 2018 20 cents per mile driven for medical or moving purposes up 2 cents from 2018. For 2022 the business mileage rate is 585 cents per mile. 2202 - Mileage Reimbursement.

Employees will receive 575 cents per mile driven for business use the previous rate in 2019 was 58 cents per mile Employees will receive 17 cents per mile driven for moving or medical purposes this is a substantial increase from just 2 cents per mile in 2018. 1 585 cents per mile driven for business use up from 56 cents for 2021. SAN FRANCISCO KPIX 5 -- California is moving closer to charging drivers for every mile they drive.

![]()

Best Mileage Tracker Mileage Log App Freshbooks

Irs Mileage Reimbursement Guide Irs Rules And Rates

County City Leaders Push Back Against Proposed Mileage Tax

/ScreenShot2021-02-06at6.37.24PM-e6ebd594161f4e2dba070ffdf962076c.png)

Form 2106 Employee Business Expenses Definition

Local Mayors Get Cold Feet On Plans For Mileage Tax On San Diego Drivers By 2030 Kpbs Public Media

Irs Mileage Reimbursement Guide Irs Rules And Rates

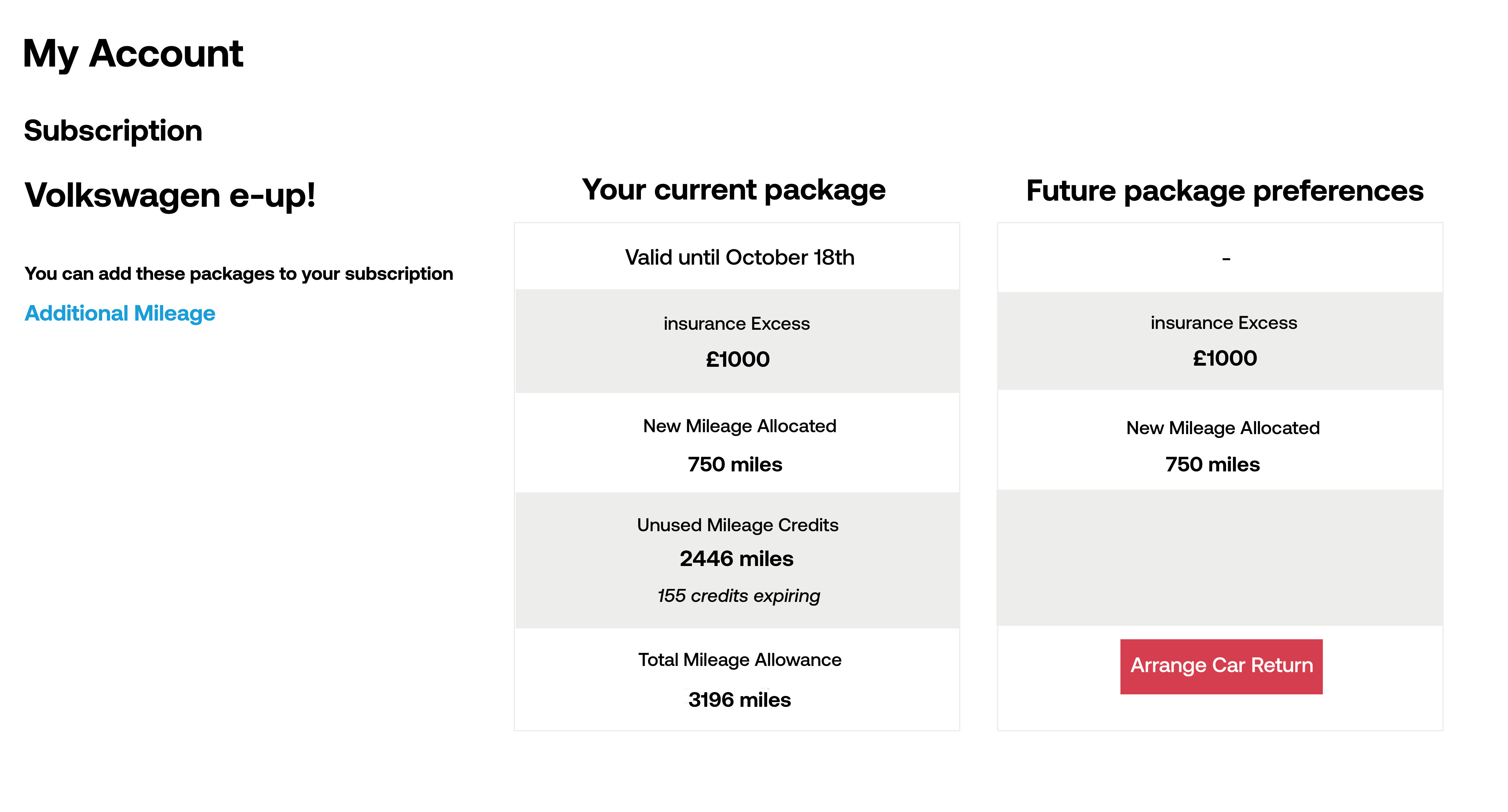

How Mileage Works With Onto Onto Electric Car Subscription Middot Onto

What Are The Mileage Deduction Rules H R Block

California Employers Association 2022 Irs Mileage Rate Is Up From 2021

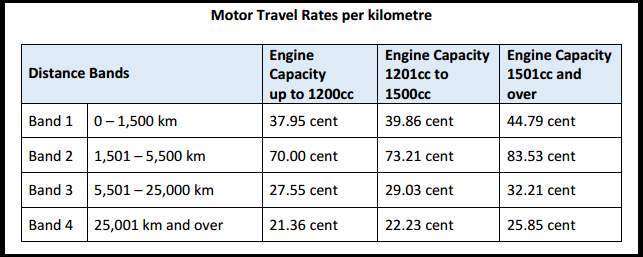

Civil Service Mileage Rates Documentation Thesaurus Payroll Manager Ireland 2022

Vehicle Mileage Tax Could Be On The Table In Infrastructure Talks Buttigieg Says

Mileage Reimbursement A Complete Guide Travelperk

Mileage Reimbursement Calculator

Vehicle Mileage Tax Could Be On The Table In Infrastructure Talks Buttigieg Says

California S Road Usage Charge Pilot Program Stirs Controversy The Coast News Group

Free Mileage Reimbursement Form 2022 Irs Rates Pdf Word Eforms

Sandag S Proposed Road Charge Would Piggyback On California S Plans For A Per Mile Driver Fee The San Diego Union Tribune